What is an enrolled agent? (www.IRS.gov)

An enrolled agent is a person who has earned the privilege of representing taxpayers before the Internal Revenue Service by either passing a three-part comprehensive IRS test covering individual and business tax returns, or through experience as a former IRS employee. Enrolled agent status is the highest credential the IRS awards. Individuals who obtain this elite status must adhere to ethical standards and complete 72 hours of continuing education courses every three years.

Enrolled agents, like attorneys and certified public accountants (CPAs), have unlimited practice rights. This means they are unrestricted as to which taxpayers they can represent, what types of tax matters they can handle, and which IRS offices they can represent clients before.

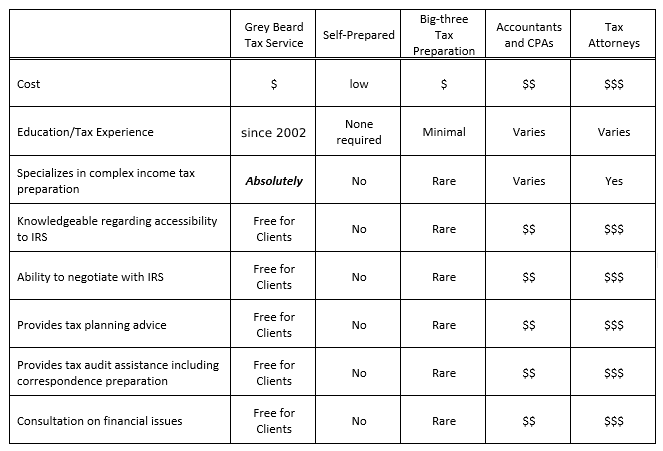

Compare

A Word About Fees

Tax preparation services by Grey Beard Tax will always cost less than CPAs and Attorneys and usually will be lower than most tax accountants and the big-three tax preparation companies. In fact, if you were with a different professional service last year, Grey Beard Tax Service guarantees your fees will be at least 10% lower than last year’s fee (just show us last year’s receipt).

And, if Grey Beard Tax has prepared your return, any consultation and IRS interaction is FREE (unless a new tax return is needed).